Assessed vs. Equalized Value

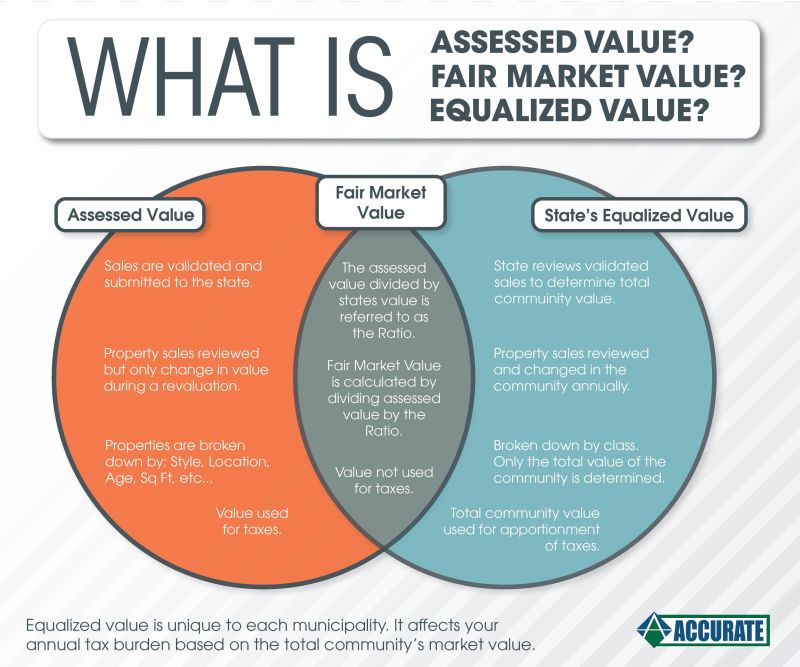

Assessed Value: This is the dollar value placed on a parcel of property by the Village Assessor. It is computed by analyzing individual sale transactions, inspections, and a thorough study of all Bayside neighborhoods. It is the assessor's estimate of market value. It is important for maintaining equity between and among all taxpayers in the Village.

Equalized Value: This is calculated by dividing the property's total assessed value by the average assessment ratio. This ratio is applied to all property, including personal property, regardless of type or location of the property. In theory, this should approximate the current market value of the property. This value estimate is determined by the Department of Revenue (DOR). It is used to apportion tax levies among municipalities and is used in the distribution of shared revenues.

History: Back in the early 1980s, when the legislature passed the law that this be included on all tax bills, was a time across Wisconsin when assessors for the over 1,800 municipalities were not required to assess property at market value during any time interval. As a "truth in taxation" measure, the legislature thought it was important for their constituents to know what in terms of value their assessment actually meant. Because the DOR already prepared municipal "equalized values," the legislature thought that these estimates made at the municipal level should be provided at the property level. This was an easy answer to their problem. Remember, the intent was to show whether the assessment on a property was at all accurate. It was never meant to actually be your individual property estimate. But, at least from a taxpayer's standpoint, it meant more than the assessment at that time. For instance, if the assessor was assessing property in your municipality at 10% of fair market value (and you had no idea of that fact) and your tax bill showed an assessment of $10,000 you might think "boy am i getting a good deal - I know my house is work at least $60,000." However, if you realized that the $10,000 actually equated to approximately $100,000; you might not be so happy. (Since 1986, after this was enacted, the legislature tightened the law and we now are required to assess within 10% of market value at least once in every four year period.)

History: Back in the early 1980s, when the legislature passed the law that this be included on all tax bills, was a time across Wisconsin when assessors for the over 1,800 municipalities were not required to assess property at market value during any time interval. As a "truth in taxation" measure, the legislature thought it was important for their constituents to know what in terms of value their assessment actually meant. Because the DOR already prepared municipal "equalized values," the legislature thought that these estimates made at the municipal level should be provided at the property level. This was an easy answer to their problem. Remember, the intent was to show whether the assessment on a property was at all accurate. It was never meant to actually be your individual property estimate. But, at least from a taxpayer's standpoint, it meant more than the assessment at that time. For instance, if the assessor was assessing property in your municipality at 10% of fair market value (and you had no idea of that fact) and your tax bill showed an assessment of $10,000 you might think "boy am i getting a good deal - I know my house is work at least $60,000." However, if you realized that the $10,000 actually equated to approximately $100,000; you might not be so happy. (Since 1986, after this was enacted, the legislature tightened the law and we now are required to assess within 10% of market value at least once in every four year period.)

The reason DOR equates all municipalities to an estimate of fair market value (equalized value) each year is to ensure the uniform distribution of shared taxes across municipalities. The assessor, on the other hand, assesses each property to make sure that each property pays their fair share of tax on an individual level.

The equalized value on the tax bill is a less reliable estimate than that prepared by the assessor. The DOR has never inspected any property in the Village of Bayside. It is only to be used as a tool to check your assessment.